Follow up on NCTY trade

It was a good call to get out in afterhours yesterday - there just should not have been any hesitation. ;) Still even though I knew instantly that I was not satisfied with the financial results - I figured that I would wait 30 minutes to see the market reaction in the after hours market. Most buyers/sellers reacted similar to me - other than a few suckers who could have bought from me at higher price! I don't know if there is any "lesson" from this one. But there are a few interesting points - 1) after setting a clear goal in terms of the financial results expected - when those are not met - it is not good to stick around in the stock "hoping," - you can always come back. and 2) be careful of the indicators that you use and your ability to sell even yourself on the story. I had believed that my analysis re: other stocks in the sector and also the positive price action during normal hours trading yesterday was bullish for NCTY. I also thought that low expectations were in the stock already - obviously not - as stock is down 10%+ today from yesterday's $18.50 close.

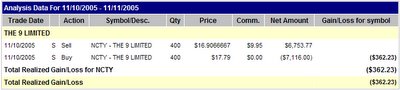

Re: longer term story unfolding at NCTY - I need a good few hours to go through the earnings report and also to read the 10-Q quarterly SEC filing when it comes out. Then I can do a more fundamental analysis on long term prospects, etc. Leaving it at that - here is the entry/exit, profit/loss, etc.

Profit/loss chart:

Entry/exit chart:

My timing and perception of value/market direction is not working right now. I will probably use this as another opportunity to back off a little bit. I will continue to track the following markets though -as I consider them key to understand the current rally: financials, interest rates, gold, the dollar, and government statistic - re: CPI, PPI, etc.

My timing and perception of value/market direction is not working right now. I will probably use this as another opportunity to back off a little bit. I will continue to track the following markets though -as I consider them key to understand the current rally: financials, interest rates, gold, the dollar, and government statistic - re: CPI, PPI, etc.Best regards,

BG

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/images/live/s_gold.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/images/live/s_silv.gif)

0 Comments:

Post a Comment

<< Home