Rambling on

I am going to take a few minutes tonight to elaborate on the property market put option strategy and how I expect the short side game to play out. I will try to outline my key assumptions first and the factual basis for those assumptions so that it will be easier to criticize my approach. I would like to make the plan as robust as possible I think that the profit potential will be great in due time.

Key assumptions:

1. Real Estate market on both coasts of the USA is currently in a bubble and is overpriced by 100-200%.

Notes: I can speak to this point by personal experience. In my hometown prices have appreciated approximately 250% since 2002. In some areas of San Diego and Southern California the price increase has been closer to 300-350%. Granted there has been inflation over the past 4 years and also growth in the economy incomes. Interest rates have also been at historical lows making homes more affordable. This logically makes the home price increase. At 10% interest rate you may afford a $200,000 home. But at 5% interest rate you can make the same payment and own a $400,000 home. If everyone had locked in a fixed rate mortgage at the bottom of the cycle - then maybe the market could just level off for 5 years before accelerating again to the positive. Instead - we are looking at here is a climate where many, I would say even the majority of owners have variable rate mortgages where the costs will increase along with interest rates over the coming years. This means that maybe someone started out with the 5% interest rate that they could afford the $400,000 house but when their mortgage rate adjusts to 8% they can only afford the $280,000 home. They will be able to stretch for a while but if interest rate stays elevated they are forced to sell or worse are foreclosed on and the market price is further impacted to the downside. This paragraph was mainly dedicated to affordability issues and the impact of low interest rates on asset prices - but the following paragraphs will more closely dissect the interdependence of the economy and home prices and real estate gains.

2. The bubble impacts more than just house prices. Many sectors of the economy are dependent on continued home price appreciation.

Notes: Certain sectors of the real estate industry have experienced enormous cyclical growth over the past five years that most people falsely consider a secular story. Construction workers, real estate agents, real estate appraisers, escrow companies, mortgage brokers, property management companies, banks, mortgage insurers, title companies, and homebuilders. Who among you has a friend or even family member who works in one of these industries or just got a great new job in one of the above. These have been and continue to be the "growth" areas of the economy for the average joe. Home prices do not have to decline 50% for these areas to be impacted. We can experience a modest 5-10% decline in prices that is coupled with slower sales volume/turnover and 20-30% of the workers in the above industries can lose their jobs or experience a large % decline in their earnings power. This action is precisely what leads to further declines in property prices and further attrition in these key industries as the previous workers that were stimulating the economy through spending and home purchases are now out of work and forced into savings or lower paying jobs.

The above scenario has not even mentioned the end to home equity extraction. Home equity extraction can only juice spending though as long as 1) home price increases and 2) low interest rates are in the works. Alan Greenspan published a paper on the Fed website last year discussing precisely this phenomenon. Here is the link: Greenspan Paper

Thats right - the "maestro" himself. He estimated that home equity extraction hit $1 trillion dollars in 2004. Think of the commissions that generated for workers in the sub-sector industries discussed in the above paragraph as well as the extra dollars in homeowners pockets to lay down some dough for that new SUV.

3. When the bubble does crack and the price declines begin, we will reach a certain point where the down cycle becomes self-reinforcing so that the price decline and growth decline in correlated industries will accelerate until they overshoot to the downside past the point of intrinsic value (if there is such a thing.)

Notes: I expect the downcycle to play out over several years. I also expect the negative economic impact of the failure of the sector to have a slowing impact on the economy and a slow down on inflation. I expect the Fed to become concerned about deflation again quickly and perhaps only 6 months - 1 year into the decline. This leads to the next assumption.

4. The property market "crash" is going to impact the economy so negatively that the government will be forced to formulate numerous regulatory solutions. All of the practical regulatory responses lead us to inflationary / hyperinflationary endgame.

Notes:

This point is highly debatable and speculative as the crash has not happened yet. I am not going to hit on this point too much tonight as it is too bullshit even for me to tackle right now. Still this is what I expect in the longrun and it is how I am ultimatelyh planning on positioning my capital when time has arrived. Marc Faber discusses this topic pretty thoroughly in his book Tomorrow's Gold.

Implications:

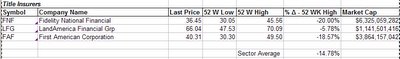

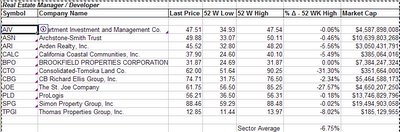

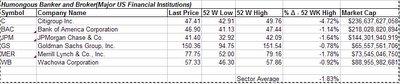

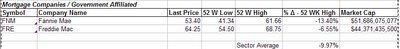

Well folks - that took longer than I expected, but I am glad to get it out of my system. That is the rationale behind the whole strategy, but the actual mechanics of it merit the most discussion. The first point is when does the downside game start? And what industries will it affect? I am publishing the following list of sectors and subsectors again so that we can check out the companies that I am tracking on a weekly basis. The chart just measures the % decline from 52 week high. This data is useful just to the extent that it tells us when the better and higher probability shorting setups will present themselves. The best opportunites should not arrive until the stocks are down at least 30-40% from their 52-week highs. It will only be at that point that the stocks are in a confirmed downtrend and we can more surely enact a technically based trading plan that will have us selling at price resistance instead of selling at support levels. :)

Here are the details on the sectors and stocks. I will sign off here tonight and we will probably do a case study on Freddie Mac sometime in next few weeks. There we will look at the value of trying to pick a top and whether I will jump the gun or not. Still - the best and highest probability setups are not going to arrive until most of these sectors are at 30-40% below 52-week high and in confirmed downtrends.

| Summary - % Decrease from 52-Week High | |

| Sector | Change |

| REIT - Retail | -0.70% |

| REIT - Industrial | -1.66% |

| REIT - Hotels | -1.67% |

| Humongous Banker and Broker(Major US Financial Institutions) | -1.83% |

| Mortgage Insurers | -2.07% |

| REIT - Diversified | -2.11% |

| REIT - Office | -3.42% |

| REIT - Healthcare | -4.23% |

| Real Estate Manager / Developer | -6.75% |

| Mortgage Companies / Government Affiliated | -9.97% |

| Mortgage Companies | -11.22% |

| Title Insurers | -14.78% |

| Homebuilders | -22.78% |

| Mortgage Investment Trusts | -29.98% |

Best regards,

BG

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/images/live/s_gold.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/images/live/s_silv.gif)

0 Comments:

Post a Comment

<< Home