2005 Year in review

This closes up the first year of the blog. I think it was a worthwhile experiment, although right now I will admit that I have hit a blank spot. I don't have a lot of ideas for sectors / investments in 2006 and I have very little conviction about where to put the money. I also currently fear committing the capital, which puts me in a horrible position to make an objective decision. Given this shakiness I am going to sit in money market with the 3% nominal return (probably losing against inflation) until my thoughts clear a bit more and I have had more time to think out a plan. I don't know when I will be ready - if it will be in first weeks of January or closer to middle of the year. I will continue to comment on what I think are interesting developments, but to invest in something now I think would be too foolish even for me. I will review 2005 though now as a history of successes and failures:

2005 investing/trading successes:

1) I am back in the black over past five years in my account. After taking the initial hit of 4K that I invested in 2000 when the company I picked went bankrupt - I have (at least momentarily) recovered the lost capital. Still compound return over those five years is dissapointing (2.4%).

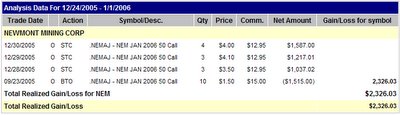

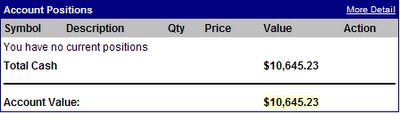

2) Gain on investment in 2005 was close to 50%. I began the year with approximately $5K in capital (100 shares of NEM ($42), 36 shares SFL ($20)) and after 1 contribution of $2K, bringing total capital of around $7K - I finished the year with about $10,500. That is a healthy return - except when you consider the substantial risk that I took on in order to earn it.

3) Good calls on specific stocks/sectors: NEM, SNDK, precious metals, homebuilders (PHM)

2005 investing/trading failures:

1) Although many ideas existed about potential stock price movements or developments, I never created any type of technical system for entry/exit. I did not have a set rule for loss taking and likewise for gains I did not have a set exit percentage or target price I was looking for typically. I was trading more on emotion - which created problems for me when I became too excited in the fall.

2) This is basically a repeat of #1 - most of my actual entry or exit points were completely emotion determined - with me just acting with my best "judgment." This is not a method but of a recipe for disaster.

3) Bad calls on stocks/sectors: NCTY, XLF (financials), Gold/precious metals

Final portfolio snapshot:

So with that I appreciate all readers comments and input this year. Feedback was very positive overall. I wish everyone a Happy New Year and great 2006!

I hope to return sometime soon with more constructive analysis and a system for executing on it.

Best regards,

BG

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/images/live/s_gold.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/images/live/s_silv.gif)