Lazy

So lazy...........that is my feeling as of late. Summer school has actually been quite interesting and relaxing, and although I have been very active in my trading I have felt no urge to post. The portfolio is still hovering in the 4K-5K range and I feel great about my positions heading in to the next few weeks. Silver Wheaton (SLW) has taken off like a rocket and I unloaded 1/3 of the position today for a 100% profit. I plan on unloading another 1/3 in the $10 area which I think is reachable by mid next week.

I also doubled down my position in GGC - purchasing another 50 calls for the August expiration for a nickel each which cut my average cost from 0.66 to 0.36. I am just looking for a breakeven on this one at this point in the game although that may be too optimistic. I am still counting on great earnings and the stock trading back into the $30 range, but not higher.

My position in Webzen has been ticking up everyday as well and I anticipate it trading in the $7 range sometime in the next few weeks as soon as the banks suck in some more sucker retail money. This is a sucker's rally plain and simple - but it has proven to be extremely powerful and just made a huge huge move. Webzen is my position with the most potential. If they make some positive PRs during the right market climate it could trade into the $10 range. That could move my $7.50 calls into the $3 range and turn a $1000 position into a $20,000 one. That is probably too optimistic, but I do think that $7 is in the cards.

Finally, Avalon Bay has gone straight up following the FOMC based on the lower interest rates. I think this one is in a trading range and I see it trading back into the low $100s as soon as the bond market gets a reality check following the inflation numbers in two weeks. I will buy more PUTs if necessary as I have already increased my position by 500% today.

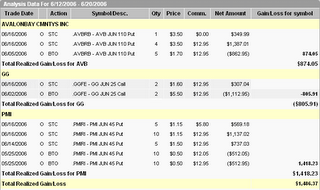

Here is the portfolio snapshot. I am positioned just as I would want to be if I went out and bought stuff all over again today. Lock and load baby:

Best regards,

BG

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/images/live/s_gold.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/images/live/s_silv.gif)