Response to the decline in NCTY has been interesting. Some have been encouraging, others have renamed me "Bad Luck Ben," other readers are value hounds and see the decline as a great buying point. The following analysis is tilted mainly to the value hounds in order to try to make the most balanced comments possible. This commentary will have three segments: 1) technical, 2) fundamental, and 3) predictive. So without further ado .......

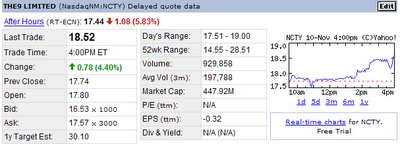

The Charts:Charting software is backup. Here are the charts:

52-week chart with comments:

10-day Chart:

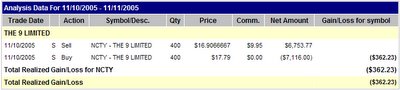

Basically - stock sold had a very high trading volume relative to its average on both Thursday and Friday. Friday had a gap down of 10%+ on notable volume. In this context and due to the low float - I think that it is quite probable that it will

retest the historic lows of $14.55 sometime in the next few months. Absent a major upgrade by multiple investment houses in the next few weeks (highly unlikely), I think that downgrades are more probable - I see

no rush to get into the stock at these prices. Stock may bounce back into 17s in the short term but I expect it to continue the downtrend over the next few months.

The Fundamentals:Although the earnings were not horrible, they were much below expectations of many of the optimists - including myself. The company had EPS of $0.19 and Revenues around $23 million. Here are a few comments - I have divided into pros and cons.

PROS:

1) Company Strategy: The CEO comes off as downright arrogant, but I like the fact that he is making efforts to partner with different companies throughout Southeast Asia. He just partnered with Softworld in Taiwan to release WOW there. By gaining a presence in multiple markets the company has the opportunity to diversify its customer base somewhat and maybe operate in some markets that are less cutthroat than Mainland China is right now. They also may gain more bargaining power when it comes to negotiating new games contracts due to the multiple markets.

I like the company's strategy to license proven winners when it comes to games as well. I believe that although developing games in house could boost margins - that is a huge capital expense right now and gamers are fickle creatures who will often focus on just one or two of the best games. So why spend millions to develop your own which may or may not be successful?

NEUTRAL:

1) Product line: Most analysts consider the fact that The9 only has ONE GAME (re: World of Warcraft) as a major negative and a HIGH RISK. I think that this is a fair point. I choose to take the other side of it though and will make a stand on this issue as I consider all Blizzard games (WOW as no exception) to be a cut above everything else out there. They are all highly addicting and they seem to no ZERO cultural barriers as they are popular throughout the world.

IMPORTANT NOTE: All that The9 effectively owns is a 4-year license to operate World of Wacraft in China. They do not have anything else significant in development and they are counting on the success of Warcraft to finance them so that they contract with other big game developers in the future (re: Blizzard again probably) to port games over to the Asian market.

They have also paid serious money to get this license and they need Warcraft to be a much bigger hit to make it worthwhile -re: $200 M in revenues a year will work it. But current trend re: $100M is going to crunch them. IMHO

CONS:1) Transparency:

I also disliked the fact that they are emphasizing different measures like EBITDA and NON-GAAP acounting measures in addition to the typical GAAP measures which is all they should be reporting. I also dislike that they are reporting most of the results in RMB (Remnibi - the Chinese Currency) instead of Dollars ONLY with RMB as footnotes.

I also think that The9 should post weekly totals of both ACU and PCU on their website as public record. ACU = average concurrent users and PCU = peak concurrent users. These metrics are extremely important across the industry because they are used as a predictive tool to determine the revenues / earnings. By multiplying (number of ACU) X (the hourly rate that is charged for the game) X (# of hours in day) X (days in quarter) - it is possible to get meaningful revenue and earnings predictions.

One of the major reasons that the earnings surprise was to the negative on Thursday - was due to only 240,00 ACU. The9 had said as of initial launch in June that they had 250,000 ACU. Many of us made the logical assumption that the game would continue to grow in popularity - quickly hitting 300,000 or even 350,000 ACU by Q3 to become the most popular game in China. Instead the ACU actually fell by 10,000 to 240,000 from the initial launch. The company made several statements in the conference call that ACU was improving in October but I am skeptical.

2) Chinese Government: The government has enacted several harassing regulations that prevent users from playing the games more than 3 hours per day because the government feels that the games are detrimental to younger kids who should be studying. They also have enacted "cafe regulations" that put age limits on who can go to internet cafes to play videogames as many kids are too poor to have a computer and internet connection at home. Remember! - average income in China is still around $2,000 PER YEAR.

Predictive:

Sector is still in a downtrend. The commonly accepted leader (NTES) got nailed when it failed to report blockbuster earnings in Q3 that all had been betting on. I do think this sector is not ridiculously overvalued relative to some companies (re: Google) - especially when you consider the growth of Internet in China and the pure numbers they have going for them. Still is there is a ton of competition and more consolidation needs to take place before clearer winner emerges.

Conclusion:I don't see any rush to buy this one or any of the other stocks in the Chinese Net sector. I don't think there is any clear winner right now and I would take this opportunity to WAIT and SEE. Why buy at $16 if you can buy in a month for $12.50 basically.

Additional notes:

I did not have time to listen to the Conference Call - but it is highly recommended for the value hounds who are looking at this as a longer term investment. Here is the link:

http://www.corp.the9.com/IR/sub_5.htm

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/images/live/s_gold.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/images/live/s_silv.gif)