Sunday, April 30, 2006

Saturday, April 29, 2006

Few comments

Just a few minor comments this weekend.

1) GGC - so far this speculaton has turned out quite pleasantly. The $35 calls which purchased are still far out of the money, but due to the increased volatility, I estimate that they have appreciated approximately 30% from their purchase price. The stock is relatively illiqud however, so it is tougher to make quick comparisons. Anyways - here is the important and relevant news. Earnings were good and the stock increased ~9% on Friday on double the normal volume. From this point I am just going to hold this one through August. I expect a spectacular earnings win for the July 27 report due to the easier year on year comp from last Q2, favorable FIFO accounting impact of the natural gas pricing, and finally continuing strong demand for GGC's products. I ended up purchasing even more call options on this one on Thursday so I now have a total position of 50 August $35 call options with an average cost of $0.66. With GGC currently hovering near 30 I think it could retrace the recent gains at some point over the next 2 weeks, still I expect the stock to trade at least in the mid 30s prior to August and if all goes well, perhaps into the mid 40s. Here is the chart:

Nice breakout above the 200 MA. But it will probably retest soon to confirm that it is now support and not resistance. Would be nice to see continued interest and higher volume for at least 2 or 3 more days in order to have some fuel for the fire and a nice sustained uptrend into the mid-30s.

Nice breakout above the 200 MA. But it will probably retest soon to confirm that it is now support and not resistance. Would be nice to see continued interest and higher volume for at least 2 or 3 more days in order to have some fuel for the fire and a nice sustained uptrend into the mid-30s.2) Dollar collapse continues. Gold hit a new high of $650 an ounce on Friday and it now looks like it might run as high as $800 or $900 an ounce by the end of the year. I may pick up a position hear on the next weakness. I am considering a position in either the new Silver ETF (SLV) or maybe the new small cap gold miners index (XGD).

Best regards,

BG

Thursday, April 27, 2006

You call that a position??#@#???

Got filled in GGC calls this morning at about .20 higher than I wanted but it was important for me to get leveraged and long in this position. I have 30 contracts at a cost of $0.70 each for the August 2006 $35 calls. All eyes and ears now on the numbers released after the close, I am off to work, we will see how this one works out.

-BG

Wednesday, April 26, 2006

Position sizing

Gearin up for a little GGC action tomorrow. Big earnings release after the close. I will take position sometime tomorrow during the day and will post a short update to let everyone know position size and also strike price and expiration. I am looking at the August 2006 $35 out of the money calls right now which will probably run in the $.50 to $1.00 range per contract. I am expecting a move of at least 20% in the stock and I am willing to take leveraged bet into it. Big question is how much capital to commit - it will probably be some place between $1,000 and $2,000 - although I have not made final decision on how much.

Best regards,

BG

Run on the dollar is starting

Take a look at the current interest rate moves going on in the treasuries markets and this chart of Euro v. Dollar over past several days - not to mention dollar v. gold, etc. Run on the dollar is starting and this means high interest rates and slower growth for the us.

Treasuries:

Euro v. Dollar:

Dollar v. Gold:

Current position of short interest rate sensitive securities and (soon to be) long chemicals seems a good fit to me. Higher interest trends should bring an end to the commodities price increase at some point, but in the process should manage to kill housing even worse. I will be spending some more time later this week on the real estate related sectors - 2nd quarter is going to be brutal for these companies.

Current position of short interest rate sensitive securities and (soon to be) long chemicals seems a good fit to me. Higher interest trends should bring an end to the commodities price increase at some point, but in the process should manage to kill housing even worse. I will be spending some more time later this week on the real estate related sectors - 2nd quarter is going to be brutal for these companies.Best Regards,

BG

Monday, April 24, 2006

Added small position in FHN today

Added 10 May Put contract with $40 strike price at $0.45 each for total of $450 investment. Favorable risk return ratio and I liked the setup on the chart. Did not commit a huge amount of capital to trade as I need to save the cash for GGC later this week.

Best regards,

BG

Sunday, April 23, 2006

FHN - New short setup

No position here yet, but I updated the real estate spreadsheet to add regional banks exposure and came up with FHN as one of the gems. It is part of the SouthEast Regional Bank subsector and just reported dissapointing earnings which were composed mainly of one-time gains, etc. If you subtract out the one-time items you can see that their net income was down about 20% sequentially mainly due to a flatter yield curve and slowing mortgage volumes.

Here is the chart:

May options are very inexpensive. I was looking at getting a position in the May 40s or May 45 PUTS. Here is the snapshot:

Best regards,

Best regards,BG

Saturday, April 22, 2006

Tough week

Heres the survey of the damage:

I am currently holding a positive year together by the skin of my teeth. What was supposed to be easy profits in the bag are instead turning into quick losses depleting my capital. So what's the next step?

I am tempted to crawl back into the cave that I came out of and put the funds into money market for a while. Still - I have done some decent due diligence on GGC and I would like to see this one through to the end. So no other trades before 4/28 other than GGC - but how much capital to commit to GGC and how to do it? I don't think I can commit more than 2K to the trade as the portfolio has just been drawn down too much. So the question is how much I want to leverage it and over what time horizon. I am drawn to the August or November call options so that if the trade is successful I could ride it for a while and benefit from any decreases in energy prices.

The opposite strategy is also attractive however in the case that energy prices do not moderate - that would be taking short term May calls and buying at the money options or slightly out of the money options. Both strategies take a positive move in GGC as the key assumption and are just testing which approach would be better.

Here are the contracts that i am looking at:

May:

I am looking at the May 25 calls or the May 30 calls.

I am looking at the May 25 calls or the May 30 calls.August:

I am looking at the August $25 calls or the $30 calls.

November:

I am looking at the November $25 calls as interesting.

So that concludes the survey. We will have to see what GGC does in the coming week to get a sure feel for the plan. Chemicals as a sector are currently rallying. I don't know if this is a dead cat bounce or if they are rallying as leading indicator of crude and energy peaking out. We will have to see.

Best regards,

BG

Friday, April 21, 2006

Ouch.......Everything Downhill From Here

Well OXPS trade also did not work out and it looks like the Calls will expire worthless. I lost another $1,400 there to bring me to negative $1,900 on last two trades. That means I am only still up $400 this year and am in dangerous territory. To make it worst still - GGC has been staging a nice rally back into the $27.50 territory and it looks like the August Calls I wanted will be much more expensive than anticipated if I had purchased them back in the $25 area.

Big reality check here. If the GGC trade goes awry I will go into the negative for the year and will have a real tough time getting back in the green. Meanwhile a positive GGC trade could give me some capital to focus more exclusively on the short side as it appears the real estate related sectors are getting ripe for the plucking.

Best regards,

BG

Thursday, April 20, 2006

Gold in freefall

Closed out the Newmont trade for $500 loss. Not loving it as I was up $700 yesterday - but that is the beauty of leverage at work. I will hang around in OXPS through tomorrow and maybe make a little back. We will see. Taking loss is so hard - but I guess practice is perfect - and it was foolish not to take it earlier today when price movement that was expected did not develop.

Best regards,

BG

Gold price rally over?

Positions are down this morning. Newmont still slightly in the money but OXPS getting killed. I am goin hold through tomorrow for both. Newmont might be foolhardy to hold as they have already reported and all news should be in stock. Still options have another day left and although gold is reversing I think it could finish this week at $650. We will see if instead I receive a big smack upside the head for veering outside the system again.......some people never learn.

Best regards,

BG

Wednesday, April 19, 2006

Bullin it

Big move in gold today to $640 an ounce. Newmont position is rocking for now. I added another position in Optionsxpress. (Currently flaunting system rules btw with approximately 35-40% of portfolio committed.) I bought the April $32.50 call options at $1.40 - 10 of them.

Best regards,

BG

Added to Newmont Position

I just purchased another 2 April 2006 $52.50 call options on Newmont Mines prior to earnings release tomorrow. Chart is looking really good and I think they have an easy comp v. last year's Q105 EPS. Total long - 4 contracts at average cost of $4.35 per contract.

Next up after Newmont will be GGC.

Best regards,

BG

Tuesday, April 18, 2006

New Position

Opened a small position this afternoon in Newmont Mines $52.50 call options. I purchased 2 for $4.40 each for a total of $880. The leverage is approximately 12-1. I am looking for the stock to run through $60-65 over next two days based on two bullish developments:

1) Newmont earnings call on 4/20

2) Fed comments released today that indicate the end of the tightening cycle. Precious metals should make another huge break on this news and we may be looking at $15 silver and $650 gold by the end of the week or early next week.

Best regards,

BG

PS I did not take a huge position as I think this rally both precious metals and stocks is extremely long in the tooth and this position is extremely spec. I was dissapointed to see GGC rally along with the other stocks today to $26 range. I don't think this is sustainable as the current bias is that oil prices will impact earnings and oil is trading at new highs around $72 per barrel.

Sunday, April 16, 2006

The Manifesto (updated)

Current Thoughts

1) Develop sound risk management techniques for trading / investing / speculating

2) Improve my trading results

3) Identify and confront some of the perceived obstacles to success

(earlier thoughts circa 2005-2006):

I had the chance to read some choice sections of Nassim Taleb's book - "Fooled by Randomness." This is an extremely humbling - but thought provoking book to read and I recommend it whole-heartedly. Reading it though has forced me to articulate the mission of the blog and my personal strategy in greater detail:

Goals of the Blog:

1) Keep me honest

2) Track the investing performance in realtime

3) Encourage open and honest interchange between readers and myself

Basics of My Approach:

1) I want to be someone who is "lucky" as I don't think that I can be "good"

2) Copying Soros here as this is the best quote ever - "I don't want to be an expert at playing the game, although that would be nice. I want to be an expert at realizing the rules of the game have changed earlier than others."

3) I want to stick to an objective system of applying my trades, although my ideas themselves will be entirely arbitrary and subjective.

Saturday, April 15, 2006

This is pretty damn sad

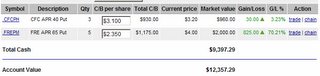

I tend to get so excited when a new position is getting contemplated and I am about to pull the trigger. Current reference is to the new GGC position. I am so excited to take the biggest call option position possible - re: 50-200 contracts if possible. The reason this is so sad - is it means I am not seeing this as a business yet - but still a gamble. Case in point - is the deviance from the system rules. The system rules have produced fantastic results year to date - 21% so far in the Q1. ($2,289.17 /$10,700 starting point = 21% return). Here is the snapshot:

So bottomline is that I can't wait to break out of the system rules that produced these results and instead risk it all. If I had no self restraint I would commit the entire portfolio capital to this trade if possible. I am forcing myself to limit the position to 20-30% of capital (notice the expansion of the rules to 30%) - but even this is probably too much.

So bottomline is that I can't wait to break out of the system rules that produced these results and instead risk it all. If I had no self restraint I would commit the entire portfolio capital to this trade if possible. I am forcing myself to limit the position to 20-30% of capital (notice the expansion of the rules to 30%) - but even this is probably too much.At least this should provide for amusing viewing.

Best regards,

BG

Thursday, April 13, 2006

Gettin GGC

Everything in this blog and my speculating successes and failures begins with a simple gut instinct. It's going to go up - or it's going to go down. Then from that point I pull up a few different methods of analysis to see if I am on point at all. I look at the chart, I look at the sector, I look at the individual company's fundamentals - I try to identify an opportunity that others are overlooking or not allowing its full potential. This strategy has manifested itself in swing trades, value plays, momentum moves - all of the above.

The current one is a value play - this is the kind of play I have not done a lot of over the last year. The main ones that come to mind are Sandisk, The9, and also Allied Waste - with mixed results. My better results typically came from technically based trades that I was in and out of quickly for a decent price change while leveraged.

The current potential position in GGC starts with the simple bias of an upward price move based on the coming earnings report. I am not going to delve into the fundamentals and technicals too much here. I will admit that I have spent a few hours looking into this one though. Here is the relevant chart:

Here is the game plan. I think this stock will trade in 21-22 range again before earnings. The chart really looks that way to me. That means I need to be patient for the best entry point. Once the target entry zone has been reached I am going to go out on a limb on this one. I am going to commit the entire portfolio to the position - this is something that I haven't done in a long time. It is probably foolhardy- and is certainly flaunting the system rules which is a major NO-NO. Hear me out though on the approach. My plan is to leave a cash position of $10,000. I will sell three $30 put options for either May or August expiration. This will obligate me to purchase 300 shares of GGC stock at $9,000 in either May or August and regardless of the market price. In exchange for that obligation I should receive somewhere in the $1,000 to $1,800 of option premium. I plan on then taking that premium and dumping it into a bundle of May and August $30 call options.

Best case scenario - The May call options are purchasd in the $.05- $.25 range and finish in the money. The PUTS I sold expire worthless and I pocket the premiums. That would give a potential return of 1000%+.

Worst case scenario - calls expire worthless and I am stuck with 300 shares of GGC stock. I estimate a lowest possible value of $18 - which would give a portfolio value of $5,400. That would be a 50% drawdown - but I think the upside here is about 1,000% - so I am willing to take the trade off.

Stay tuned for more info on this speculation. I have not committed this much capital in a long time - it should be interesting to say the least.

Best regards,

BG

Monday, April 10, 2006

Where to next?

I am feeling relatively calm with my entry / exit points lately. I am looking at more stocks in more diverse sectors than I have in a long time - re: GGC, WZEN, PHM, NEM, FRE. I am also choosing to let the positions come into the correct execution zone before pulling the trigger. The one that is currently the closest % wise is still Pulte Homes. Take a look at this chart - it is a thing of beauty. Stock price is just creepin up above that 200-day moving average. I would like to see stock break out above that on even lower volume and drift into the 42-44 range. Then when RSI is peakin around 80 I would pull the trigger and load up on the April or May PUTS. Comments are welcome - here is the setup:

Best regards,

Best regards,BG

Sunday, April 09, 2006

Selling Options

For past one year I have traded both puts and calls - but always from a long perspective. In other words - I only purchased the options contract primarily as a means for speculation and not for investment purposes.

Tonight I am going to briefly discuss the opportunities that are available through selling options. There are two main entry level strategies for selling options:

1) Selling calls (covered by underlying stock) - with this strategy you collect a premium in exchange for selling the right to someone else to buy your stock at a certain price. Basically this will limit your upside - but in a down or sideways market it may help to reduce your cost basis in the stock by allowing you to collect more options premium.

2) Selling cash-secured puts (covered by cash) - with this strategy you collect a premium in exchange for selling the right to someone else to sell the stock to you at a certain price. Basically this strategy is a more aggressive way to lower your cost basis in the stock. Premiums are often higher than the call premiums and you do not have the limited upside problem of selling calls. The obvious negative is that you are on the hook for the entire downside. Still as you are trading cash secured - I would argue that it is no different than if you were holding an equivalent amount of shares - you are still vulnerable to a major Enron type situation that could otherwise be controlled by diversification, etc. - but you are gaining the advantage of lowering your cost in the stock the majority of the time.

Bottom line is that I think both of the above strategies are better suited to an investment approach than a speculation. Coincidentally I also happen to have some more conservative investment type value plays to go with. Who? What sector? The chemicals. I am not sure if they have hit the bottom in this down cycle or not - it is probably heavily contingent on oil pricing, etc. - but they are near 52-week lows.

One potential candidate is Georgia Gulf Co. This one is trading around $26.74 right now with 52-week low in the $21 range and 52-week high in the $46 area. The specific strategy would be to sell November 2006 puts at the $30 strike price - probably 3 contracts for $5 each. I would collect $1500 of premium. I would also concurrently purchase 300 share of the common stock - or maybe if I am feeling more speculative I could purchase 6 calls at the $30 strike price for $2.25 each, for a total of $1350.

Anyways - here is the chart:

I almost - forgot - I should give a little more detail on the fundamentals behind this play. First off - this is a chemicals company and is heavily dependent on energy in order to make its product - large amounts of energy - like oil and natural gas which has been extremely expensive over the past few years.

I almost - forgot - I should give a little more detail on the fundamentals behind this play. First off - this is a chemicals company and is heavily dependent on energy in order to make its product - large amounts of energy - like oil and natural gas which has been extremely expensive over the past few years. If you look at the chart - GGC happened to hit its 52-week low - last fall right after Katrina when oil and natural gas went through the roof. That is no coincidence in my opinion as I believe that there is a negative-correlation between the two. Bottom line - I think the commodities bull is getting long in the tooth intermediate term and I see gold, oil, and silver complex selling off this year. When? I don't know - maybe gold has to hit $650 first and oil $90 first -we will see. I am keeping a close eye on this sector though. It is beaten down and this stock in particular could have a hell of a relief rally back into the high 30s if the oil price comes off even $10-15 like it did in the spring.

I am just planning on executing the transaction with a new twist this time - the PUTS sale. Execution time frame - probably in next couple months. Execution target area - here would be OK, but I would prefer right around the 52-week lows.

Best regards,

BG

Still Bullin It

Not many comments from me this weekend. I think that bull market in stocks is still all on. Although we have discovered the importance of the yield curve and rising interest rates in the past week. The important relationship between interest rates up and market down and vice versa has reasserted itself. Here is a snapshot of the interest rate moves:

Yield curve has a healthier shape to it with long rates higher than short, but the general rise across the board in interest rates is bound to continue to put pressure on both stocks on real estate. I think we are seeing two major drivers here: 1) foreign selling of our bonds due to dollar fears and 2) higher inflation expectations being priced into bond returns.

Yield curve has a healthier shape to it with long rates higher than short, but the general rise across the board in interest rates is bound to continue to put pressure on both stocks on real estate. I think we are seeing two major drivers here: 1) foreign selling of our bonds due to dollar fears and 2) higher inflation expectations being priced into bond returns.I am not sure what the cracking point is for our stock market but I think that 5.5% - 6% on the 30-year is probably a good bet. I have been following my real estate meltdown spreadsheet closely to highlight the progress of the subsectors :

| Summary - % Decrease from 52-Week High | |

| Sector | % Change |

| Humongous Banker and Broker(Major US Financial Institutions) | -2.82% |

| Mortgage Insurers | -3.50% |

| REIT - Diversified | -6.99% |

| REIT - Hotels | -7.06% |

| REIT - Retail | -7.14% |

| Mortgage Companies | -9.64% |

| REIT - Office | -9.77% |

| Real Estate Manager / Developer | -10.00% |

| REIT - Industrial | -10.06% |

| REIT - Healthcare | -10.11% |

| Mortgage Companies / Government Affiliated | -13.60% |

| Title Insurers | -14.98% |

| Homebuilders | -22.96% |

| Mortgage Investment Trusts | -29.47% |

As you can see the REITS and lenders are still probably in bull cycles. It is instead the homebuilders and mortgage investment trusts which may have already entered the bear. I plan on being patient while watching the REITS and mortgage companies put in a top - although long term these will probably be the best shorts.

I am thinking of probing again on the downside this week with either Toll Brothers (TOL) or Pulte Homes (PHM) - still I would like to see both stocks make a false breakout above the 200-day moving average before I began the position. Here are the charts:

Thats it for this weekend. Again not much conviction on the starting point - but I do think I have some good candidates for getting the positions going again.

Thats it for this weekend. Again not much conviction on the starting point - but I do think I have some good candidates for getting the positions going again.Best regards,

BG

Friday, April 07, 2006

Freddie and the homies

Finished up the Freddie Mac trade today. I closed it out at $5.40 per contract for a very respectable gain of 100%+ on the trade. Here is the p and l snapshot:

I may re-enter this one for another round at some point in coming months. For now though I am out and in 100% cash. Also - unfortunate development - re: summer school. I had to take all the profits and then some from past few trades in order to make bills for summer school so cashed out $2,500 and portfolio is back at $10,500 and ground zero. Hopefully during course of year there will be a few more good ones to keep it goin.

I may re-enter this one for another round at some point in coming months. For now though I am out and in 100% cash. Also - unfortunate development - re: summer school. I had to take all the profits and then some from past few trades in order to make bills for summer school so cashed out $2,500 and portfolio is back at $10,500 and ground zero. Hopefully during course of year there will be a few more good ones to keep it goin.The next setup I am lookin at is in the homebuilders. Pulte Homes. I have shorted it before and I plan on shorting it again here - probably very soon. The chart is extremely tempting at this point but I think it still rebounds higher one more time before the optimum entry point. Another impressive candidate is Toll Brothers (TOL).

The main thing that makes the homebuilders so attractive at this point is all the value-based buying interest that has been generated over last several weeks. A lot of new money has piled back into this sector driving prices up in the short term. This creates some opportune entry points as you are able to initiate the new shorts from established resistance levels instead of forcing things and initiating the short from a support zone with the hope that it will break through. This is more of a give and take type strategy and is more in tune with current market that has not given clearly telegraphed bull or bear signals up to this point.

That is the bottom line for now. I should be back later this week or next if new position gets under way.

Best regards,

BG

Wednesday, April 05, 2006

Bear market rally or get bullish

Market is still bullin big time. I am thanking my lucky stars that I have stuck to the system rules so far. I was forced to take profits in Freddie Mac on Monday even though I wanted to make more $$$, but system required the exit point. The expected additional profits have not yet materialized and it looks like I unloaded some contracts at the low of the day. This is great and is helping to build a little more confidence so that I will be able to probe again soon.

Top picks to start the shorts again - PHM, CFC, FRE, FNM, FED, AVB. I think the charts for AVB and FED are still way too bullish and I will hold off there until later this summer or fall most likely. However charts for PHM, CFC, FRE, and FNM all appear to be in bear market already. PHM especially is making a significant rally back to the 200-day moving average. If you look at the relative strength index it shoud be peaking above 80 by the time that PHM approaches the 41 area. It is in that target area that I would like to add the position. I am looking at the April 2006 $42.50 puts. They might be trading at that point around $1-2 which would give an attractive leverage ratio as well as risk / reward potential. The price movement I am anticipating is a touching of the 200-day MA or maybe even a false breakout followed by a decline back into the Mid-30s. We have another week or so for the price pattern to materialize so lets see what happens.

Here is the chart:

Best regards,

BG

Monday, April 03, 2006

Unwinding some positions

I went ahead and closed out the Countrywide trade for a small profit. I became impatient with it and did not like how it was acting. As for Freddie Mac - the collapse continued and I took 1/3+ of the profits consistent with the system rules as the position overall is now up 110%+. I will continue to watch this one and would look to close out the position completely if the stock falls to 55. That would be a phenomenal gain and might be too optimistic. We will see.

Here is the P&L statements on most recent two trades -

Countrywide:

Freddie Mac:

I am not sure what is next up after Freddie Mac finishes up. I am thinking about some PUTS on First Federal (FED) - but we will have to see. I am also tempted to take a 1.5 month hiatus due to finals but maybe I am jumping the gun a bit, we will see.

I am not sure what is next up after Freddie Mac finishes up. I am thinking about some PUTS on First Federal (FED) - but we will have to see. I am also tempted to take a 1.5 month hiatus due to finals but maybe I am jumping the gun a bit, we will see.Best regards,

BG

Unbridled bullishness

Positions are hanging in there very well this morning. Considering that the market is up 100+ points and my entire exposure is short that is no small feat. I can't help thinking how well the positions might be doing however if the market was to get a reality check. Still this period appears eerily reminsicient of early 2000 in terms of the strength of the market right into the face of the rate tightening. We know how that ended, but we also know how long it went on.

I am keeping a close eye on the two positions and will likely keep them on for a few more days to give the market some more time to crack. Still up slightly in Countrywide while Freddie Mac is still declining moderately. Don't panic. ;)

Best regards,

BG

Saturday, April 01, 2006

Focus on the stock price movement

It was a good week. I unloaded the silver position in the right area, the Freddie Mac PUTS have worked out in spades so far. I could not ask for anything more. I even got a solid 10 hours of sleep last night and believe me, it has been a while since I have felt so rested.

So....looking forward what is the game plan? I will look at the positions on an individual basis first and then the big picture in conclusion:

Countrywide: I almost unloaded this one on Friday. It looks like it is approaching 37 again (original entry point.) We will find out all too soon if this is a breakout area or a resistance area (my suspicion). Still if it breaks through I will have to dump this one as the stock price hasn't been doing what I expected.

Freddie Mac: It appears that I correctly identified an important break of support (200-day moving average) on Thursday. Despite the major event driven news of Friday - this thing fell like a rock. I took a few minutes to listen to the conference call on Friday morning (I was awake at 4:00 AM........don't ask.) And the conclusion after listening to the Q&A with the analysts was that the management has no clue what is going on. They sounded like career politicians, not executives, and they are responsible for over $1 trillion in mortgage guarantees. Not a good situation in the least. Technically I think it can trade as far down as $55 without a bounce if everything goes well. That would make it one hell of a trade - so maybe I am out of line - but so far the price action is very encouraging.

Big picture:

I began the 2nd phase of my plan on the real property sector decline much earlier than anticipated. It is clear that not all of the sectors are being affected negatively so far. Here is the sector snapshot:

| Summary - % Decrease from 52-Week High | |

| Sector | % Change |

Humongous Banker and Broker(Major US Financial Institutions) | -2.74% |

| REIT - Retail | -3.16% |

| Mortgage Insurers | -3.73% |

| REIT - Industrial | -3.83% |

| REIT - Diversified | -3.94% |

| REIT - Hotels | -4.65% |

| REIT - Office | -5.04% |

| REIT - Healthcare | -7.26% |

| Real Estate Manager / Developer | -7.79% |

| Mortgage Companies | -10.94% |

| Mortgage Companies / Government Affiliated | -13.96% |

| Title Insurers | -15.37% |

| Homebuilders | -25.29% |

| Mortgage Investment Trusts | -27.83% |

Keep in mind though that it is only April and I do not expect the big price moves downward to come until this fall at the soonest. Think 2000. Then we hit the peak fed funds rate in May of 2000 and the stock market didn't start falling like a rock until the winter. There was the initial panic in March and April but the market recovered strongly into the fall and several of the highflyers hit new highs.

The property market is slightly different as most of these stocks are not selling at absured multiples, instead their revenues are just artificially inflated by the enormous amount of credit extended to the sector over the past five years. Still I expect potential corrections from 52-week highs over the coming year in at least the 50% range and in some of the more volatile names perhaps as much as 70%. What does this mean? There should be money to be made on the short side.

Precious metals update: I continue to like this sector this year but it has heated up a bit too much right now I think. I would like to see a decent correction and then jump back on board when the relative strength of the stocks gets below 20 and at the same time they are at important support levels. Given the relative strength of many of the stocks is greater than 80 now and they are breaking out to new highs - it is very much a momentum game at this point - and that is not a game that I can win at.

Best regards,

BG

PS re: the title of this post. I am really trying to focus my methodology on what is "actually happening" in the market and not what is going on in my head. In my head we are already in the great bear market of 2006 and 2007. Clearly with indexes at new highs - this is not the case. ;) As a result I have to constantly remind myself - what is the stock actually doing. So far the new system seems to be encouraging this transformation. Let's keep it up and maybe just maybe - make some more money.

Here are the one day stats on the Freddie Mac trade......entry point is looking good:

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/images/live/s_gold.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/images/live/s_silv.gif)