Focus on the stock price movement

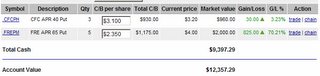

It was a good week. I unloaded the silver position in the right area, the Freddie Mac PUTS have worked out in spades so far. I could not ask for anything more. I even got a solid 10 hours of sleep last night and believe me, it has been a while since I have felt so rested.

So....looking forward what is the game plan? I will look at the positions on an individual basis first and then the big picture in conclusion:

Countrywide: I almost unloaded this one on Friday. It looks like it is approaching 37 again (original entry point.) We will find out all too soon if this is a breakout area or a resistance area (my suspicion). Still if it breaks through I will have to dump this one as the stock price hasn't been doing what I expected.

Freddie Mac: It appears that I correctly identified an important break of support (200-day moving average) on Thursday. Despite the major event driven news of Friday - this thing fell like a rock. I took a few minutes to listen to the conference call on Friday morning (I was awake at 4:00 AM........don't ask.) And the conclusion after listening to the Q&A with the analysts was that the management has no clue what is going on. They sounded like career politicians, not executives, and they are responsible for over $1 trillion in mortgage guarantees. Not a good situation in the least. Technically I think it can trade as far down as $55 without a bounce if everything goes well. That would make it one hell of a trade - so maybe I am out of line - but so far the price action is very encouraging.

Big picture:

I began the 2nd phase of my plan on the real property sector decline much earlier than anticipated. It is clear that not all of the sectors are being affected negatively so far. Here is the sector snapshot:

| Summary - % Decrease from 52-Week High | |

| Sector | % Change |

Humongous Banker and Broker(Major US Financial Institutions) | -2.74% |

| REIT - Retail | -3.16% |

| Mortgage Insurers | -3.73% |

| REIT - Industrial | -3.83% |

| REIT - Diversified | -3.94% |

| REIT - Hotels | -4.65% |

| REIT - Office | -5.04% |

| REIT - Healthcare | -7.26% |

| Real Estate Manager / Developer | -7.79% |

| Mortgage Companies | -10.94% |

| Mortgage Companies / Government Affiliated | -13.96% |

| Title Insurers | -15.37% |

| Homebuilders | -25.29% |

| Mortgage Investment Trusts | -27.83% |

Keep in mind though that it is only April and I do not expect the big price moves downward to come until this fall at the soonest. Think 2000. Then we hit the peak fed funds rate in May of 2000 and the stock market didn't start falling like a rock until the winter. There was the initial panic in March and April but the market recovered strongly into the fall and several of the highflyers hit new highs.

The property market is slightly different as most of these stocks are not selling at absured multiples, instead their revenues are just artificially inflated by the enormous amount of credit extended to the sector over the past five years. Still I expect potential corrections from 52-week highs over the coming year in at least the 50% range and in some of the more volatile names perhaps as much as 70%. What does this mean? There should be money to be made on the short side.

Precious metals update: I continue to like this sector this year but it has heated up a bit too much right now I think. I would like to see a decent correction and then jump back on board when the relative strength of the stocks gets below 20 and at the same time they are at important support levels. Given the relative strength of many of the stocks is greater than 80 now and they are breaking out to new highs - it is very much a momentum game at this point - and that is not a game that I can win at.

Best regards,

BG

PS re: the title of this post. I am really trying to focus my methodology on what is "actually happening" in the market and not what is going on in my head. In my head we are already in the great bear market of 2006 and 2007. Clearly with indexes at new highs - this is not the case. ;) As a result I have to constantly remind myself - what is the stock actually doing. So far the new system seems to be encouraging this transformation. Let's keep it up and maybe just maybe - make some more money.

Here are the one day stats on the Freddie Mac trade......entry point is looking good:

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/images/live/s_gold.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/images/live/s_silv.gif)

0 Comments:

Post a Comment

<< Home