Recent Trade Performance

Recent trading has gone well, although I have been friggin swamped with work and then even 12-13 hours on the weekends working for my inlaws slinging chop suey. I thought that I went to college and now law school so that I didn't have to work fast food.......but much to my surprise that is not the way that MY world works at least.

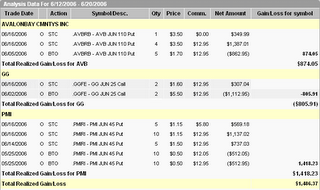

Anyways - the recent trade performance has turned out. I had a good profit on PMI and also on AVB, although I took a $800 loss in GG. Total trading profits were $1,400. This DOES NOT offset the $3,500 loss in GGC (actually $8,000 loss if you include the built-in profits). I am clawing my way back from this one and it is going to be rough getting my stake back.

I initiated a new long position today in Webzen (WZEN) - picking up the September 2006 $7.50 calls for $0.15 each - I purchased 70. I expect this thing to bounce with the rest of the market this summer and am looking for a $7-8 share price and a $1.00 each for the options. I will sell half of the options if they double and redeploy the capital into other things. I may also double down in GGC - doubling the August call positions at a $.05 and change. I figure that I can cut my cost on the options in half into the $.30 range. They should still blow out earnings. Stock may hit $30 again - and maybe I can break even on the whole deal. Opinions? It should cost me less than $300 to perform the double down or 10% the cost of initial investment. Common is at $22 now - probably bottoming at $21 in a couple days. Oil is also weak as is natural gas.

Best regards,

BG

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/images/live/s_gold.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/images/live/s_silv.gif)

0 Comments:

Post a Comment

<< Home