Back?

Well - I have finally found the desire but not necessarily the time to post. I will do my best as I believe that documenting my shorting activities in the market this fall will prove extremely important and prescient.

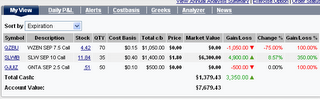

The portfolio has rattled around quite a bit this summer with a drawdown all the way to $1,200! Right now we are hovering around the $7,500 level of equity with a peak of $9,900 yesterday and an expected ending point around $12,500 in about 2 weeks if all goes well. I figure worst case we are looking at around $3K.

$5K would be enough for this fall's shorting but $3K could prove quite tight. $12,500 will present several opportunities that would not otherwise be available. So what am I sitting on now - WZEN and GNTA CALLS are not really even worth the mention as if negative values were possible they would both be negative right now. SLW is another story and I still have 35 contracts left after dumping around 10 of them during the last week for an average price of around $1.80. That recovers my initial investment and puts it at a 300%+ return. I am looking for returns on the remaining ones in the 500% level so that shows how much I am going for it - or maybe how stupid I am.

Anyways what is the short portfolio looking like for this fall?

50% shorts in WM

and 50% shorts rotating between XLF and SPY in different maturities and timeframes. XLF probably first then flowing any funds back into SPY.

After liquidating the metals I doubt I will be long again until this coming spring as I believe we are about to enter a debt liquidation deflationary cycle the likes of which this generation has never seen or even imagined. This will result in metal prices falling and although the relative performance will be better than other real assets including property - I still don't like negative returns.

Assuming a 10K starting amount I think we can set a reasonable target of 100%-200% return on equity in the shorting options although the results could be much better or worse. You will see it here first when I initiate the positions and I expect a start date around the 20th of this month of September.

Here is the portfolio snapshot for what it is worth:

I also am going to take the opportunity to welcome some new readers to the blog - mainly another Cal Bears Alum. It is nice to see my former classmates and more importantly my friends having so much fun and kicking so much ass out there in the business world.

Anyways enough reminiscing - what do you need to do the shorts? You will be long PUTS so you need at least 2.5K and an options Level 2 enabled trading account. I will pick the securities and we will all see the results. Its an exciting time and if all goes according to plan I will be back next spring to get majorly long AIG to the tune of 100+ contracts hopefully for the 2009 CALLS. Quite honestly I thought this blog was done forever a month ago along with my trading account. For better or worse I was given another opportunity and I plan on making it worth everyone's while.

Now, a moment of silence for those holders of GNTA who lost their shirts and maybe more this afternoon. I bought $500 worth of calls but I guarantee that there are those who lost more. I knew it was a speculation and expected to lose every penny but sometimes you just do things on pure principle alone.

Finally - get pumped - we are going into a world of speculation / investment that few have tried and even fewer have succeeded at. Only the greats - Soros, Robertson, O'Neill, etc. - have ever successfully developed a shorting program although they each had their own approach. I like Soros boom/bust cycle and inter-industry analysis the best and that is the model that we will be using - mainly focused on this property cycle taking its last few breaths.

Please shoot any questions / comments to bengreen@gmail.com - lets do this together and do it right.

Best regards,

BG

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/images/live/s_gold.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/images/live/s_silv.gif)

0 Comments:

Post a Comment

<< Home